Tether, the company behind the Tether (USDT) stablecoin, acquired 8,888 Bitcoin (BTC) worth $618 million on March 31.

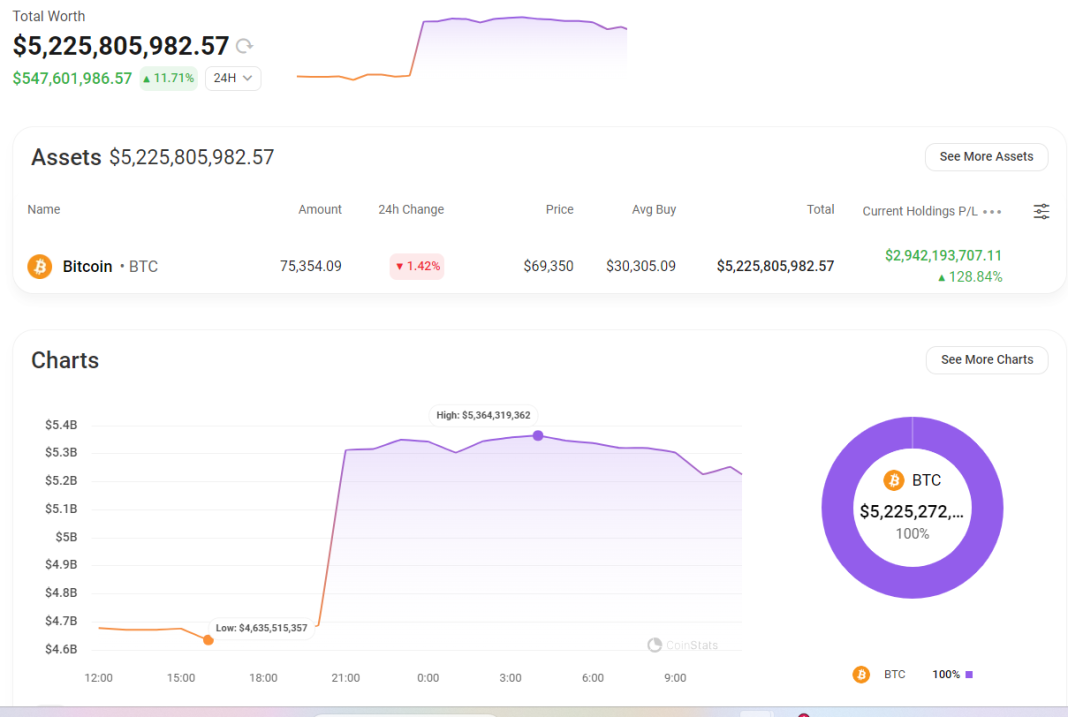

Following the acquisition, Tether’s wallet now holds 75,354 Bitcoin, bought at an average price of $30,305, worth around $5.2 billion at the time of writing, according to on-chain data.

The wallet is up over 128%, with a current unrealized profit of $2.94 billion, according to CoinStats data.

The acquisition came during a time of heightened institutional interest in Bitcoin due to the approval of United States-based spot Bitcoin exchange-traded funds and the incoming Bitcoin halving, which is set to reduce the block supply issuance in half in just 19 days.

Related: Is the Bitcoin halving the right time to invest in BTC?

Following the acquisition, Tether is now the seventh-largest Bitcoin holder in the world, according to Bitinfocharts data. Binance’s cold wallet is the largest Bitcoin holder, with over 248,597 Bitcoin worth $17.31 billion at publication.

The firm said it would invest 15% of its net profit into Bitcoin to diversify the stablecoin’s backing assets.

Tether’s USDT reached a record $100 billion market cap on March 4, posting a 9% year-to-date growth.

Related: Tether plans major expansion into BTC mining with $500M investment: Report

Bitcoin trades above $69,000, suggesting end of pre-halving correction

Bitcoin price fell 1.23% in the 24 hours leading up to 8:45 am UTC to trade at $69,523. The world’s first cryptocurrency has been trading above the $69,000 support line since March 25 despite the market experiencing the largest quarterly options expiry event on March 29.

Bitcoin’s pre-halving correction could be over since Bitcoin flipped its old all-time high of $69,000 into support, said pseudonymous crypto analyst Rekt Capital in a March 26 video analysis:

“Bitcoin is now peaking beyond this old all-time high, potentially positioning itself for this pre-halving retracement to be over.”

Bitcoin reached a new all-time high before the halving event for the first time in the cryptocurrency’s history. Despite its strong price action, the halving is still not priced in to “full extent,” Basile Maire, the co-founder of D8X decentralized exchange and former UBS executive, told Cointelegraph.

Bitcoin has just closed seven monthly green candles in a row for the first time in history.

Related: How high can Bitcoin go? New BTC price prediction sees cycle top at $180K