Image source: Getty Images

Past performance is no guarantee of future returns. But new research from eToro suggests that now could be a great time for me to load up on FTSE 100 shares.

The Footsie‘s up 1% so far in December in what some say could be the start of a Santa Rally. Markets are rising on hopes of imminent interest rate cuts by the Federal Reserve, along with tax reductions under the returning President Trump.

History shows that December rallies are no rare occurrence. According to eToro, “stock market investors enjoy almost a quarter of their annual returns in December“. And UK investors in particular gain the most from end-of-year fizziness on financial markets.

The FTSE outperforms

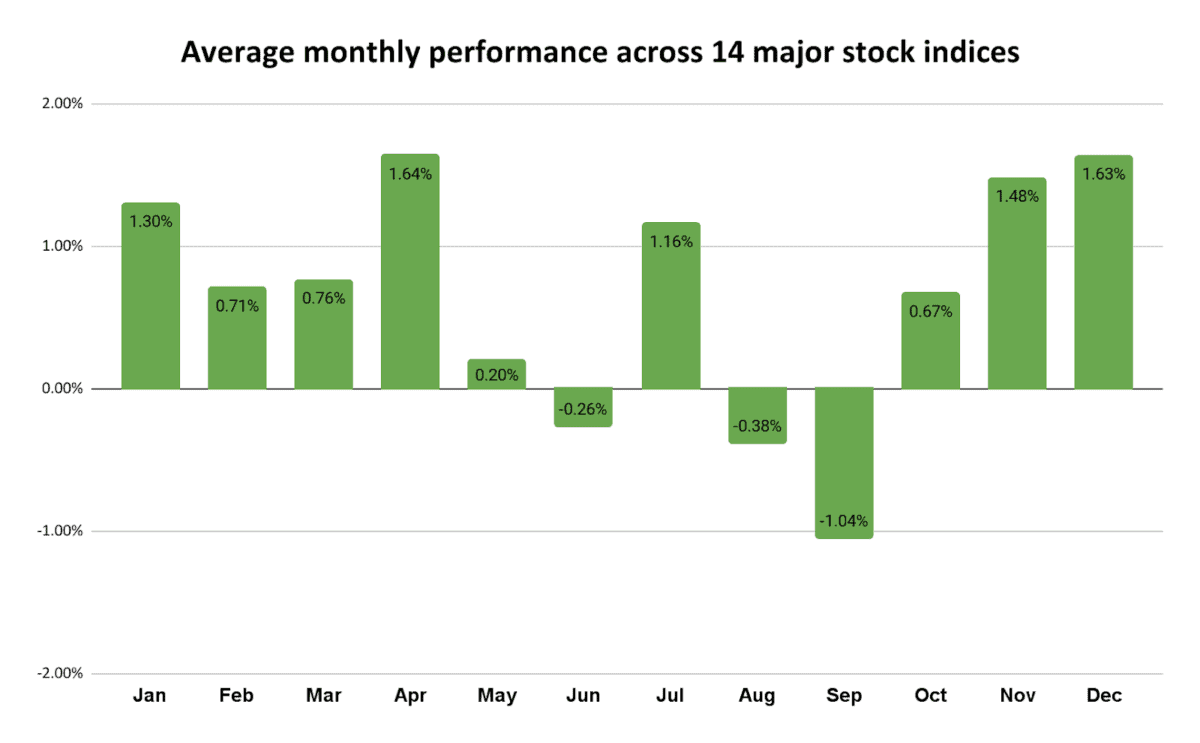

Broker eToro looked at the performance of 14 major global indexes during the past 50 years. It showed that “returns in December average 1.63%, comfortably outpacing the 0.57% average monthly return from January to November“.

Encouragingly for UK investors, the FTSE 100 has left almost all other major indexes in its wake over past festive periods, too.

It has delivered an average December return of 2.29% since its formation in 1984, outperforming the other months of the year by a meaty 1.93%. On average, a whopping 36% of the Footsie’s annual returns have been made in the last month of the year.

December’s average return is better than the 1.28% that the S&P 500 has provided in recent decades. Only Hong Kong’s Hang Seng index has provided a better average final month return across major global indexes, at 3.09%.

A top stock I’m considering

As I said at the top, past performance is not a reliable guide to the future. And right now, fears over US trade tariffs, China’s struggling economy, and war in Europe and the Middle East all pose a threat to this year’s Santa Rally.

Yet despite macroeconomic and geopolitical risks, I feel that stock investing is worth serious consideration, whether that be in December or any other month of the year.

This reflects the superior long-term returns investors enjoy versus just holding money in cash. Someone who bought a FTSE 100 tracker fund in 2019, for instance, would have enjoyed a solid average yearly return of 6.2%.

Purchasing specific undervalued shares this December could provide an even-better return. Phoenix Group (LSE:PHNX) is one dirt-cheap stock I’m considering for my own portfolio.

In 2025, annual earnings are expected to soar 22%. This leaves it trading on a forward price-to-earnings (P/E) ratio of 9.4 times.

Furthermore, the FTSE company also has a price-to-earnings growth (PEG) ratio of 0.4. Any sub-one reading indicates that a share is undervalued.

Finally, the dividend yield on Phoenix shares is a market busting 10.8%.

Despite the threat of high competition, profits here could soar as falling interest rates boost consumer demand. Phoenix’s bottom line should also rise as demographic changes drive pension sales, now and over the long term.

This is a share I’m considering buying for my own portfolio. I think it could see serious share price improvement in December and beyond.