Bitcoin (BTC) balances on cryptocurrency exchanges have dropped to the lowest levels since 2018. Meanwhile, the biggest Bitcoin options expiry in history has had a muted effect on the price so far, while spot BTC exchange-traded funds (ETFs) now account for 2.5% of the circulating supply after less than three months of trading.

Bitcoin exchange balances plunge as bull market heats up

Crypto exchanges have seen nearly $10 billion worth of Bitcoin outflows this year following the approval of spot exchange-traded funds in the United States.

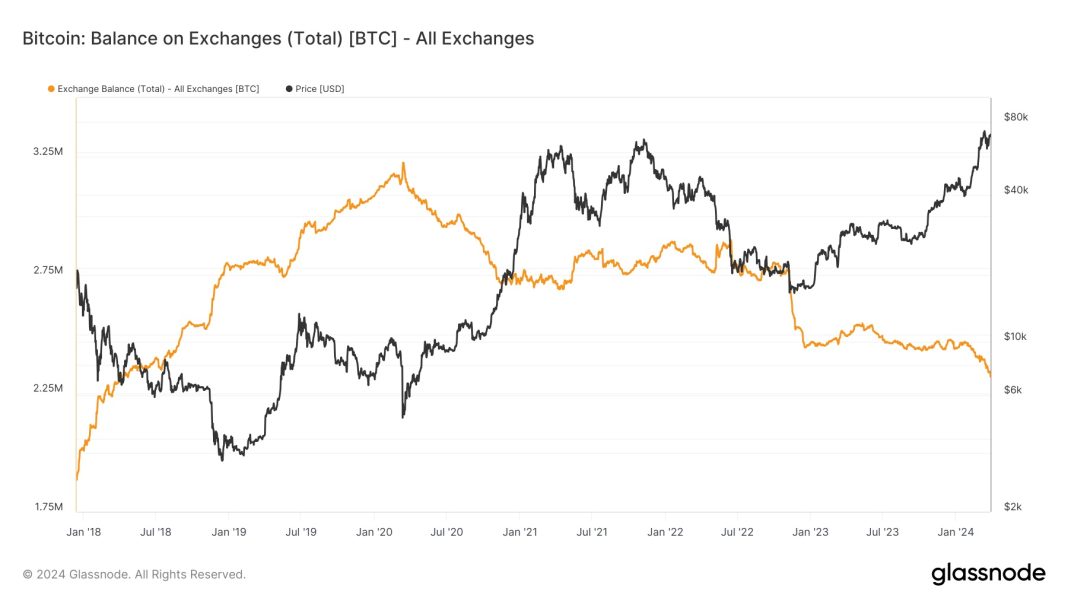

According to Glassnode data, exchange balances have declined by more than 136,000 BTC since Jan. 11, when the spot Bitcoin ETFs began trading. Overall, balances on exchanges have fallen to the lowest level since 2018.

The trend shows no signs of slowing, either, as Glassnode data showed more than 22,000 BTC was withdrawn from exchanges on March 27 — the third-highest daily withdrawal of the year.

Although Bitcoin has been rangebound for several weeks, unable to set new all-time highs, investors are growing increasingly optimistic ahead of the quadrennial halving event, scheduled for the second half of April.

“The biggest Halving in Bitcoin’s history is just days away,” said Charles Edwards, founder of quantitative Bitcoin fund Capriole Investments. He continued:

“For the first time, Bitcoin will become harder than gold, with half its supply growth rate. Pent up institutional demand via the ETFs, a programmatic supply squeeze from the Halving and Bitcoin taking the title as the world’s hardest asset. There’s a lot to look forward to in April.”

Bitcoin trades above $69,000 following largest quarterly options expiry in history

The Bitcoin (BTC) price remained above the $69,000 mark on March 29 despite the market experiencing the biggest quarterly Bitcoin futures options expiry event in history.

Over $15.1 billion worth of cryptocurrency futures options expired on Deribit on March 29 at 8:00 am UTC, according to a March 28 X post by Deribit.

Of the $15.1 billion, $9.53 billion represented the notional value of Bitcoin options about to expire at a put/call ratio of 0.84, with a “max pain” price potential of $51,000.

Despite the expiry, the price impact was minimal, said Andrey Stoychev, project manager at Nexo’s prime brokerage division.

New Bitcoin ETFs hit 500,000 BTC, GBTC outflows slow

New spot Bitcoin ETFs have accumulated over 500,000 Bitcoin since launching in January, accounting for 2.54% of the current circulating supply.

The nine ETFs that launched on Jan. 11 hit the milestone following another day of inflows on Thursday, which saw the ETFs scoop up $287.7 million in net Bitcoin, according to Farside Investors.

This brings the amount of Bitcoin held by the nine ETFs to $35 billion over just 54 trading days.

In total, all United States-based spot Bitcoin ETFs, including Grayscale, hold 835,000 BTC, which is almost 4% of the entire supply, it noted.

This week’s ETF inflows are back in the black, with $845 million in inflows measured so far this week, reversing a trend of outflows that began on March 18.

SBF gets 25-year prison sentence

SBF has been handed a 25-year prison sentence in a U.S. federal court.

According to Judge Lewis Kaplan, SBF will serve 240 months and 60 months for his conviction on seven felony charges. He was also found guilty of tampering based on the events that led to Kaplan revoking his bail in August 2023.

“Punishment must fit the seriousness of the crime,” Kaplan said. “And this. Was. A. Serious. Crime […] When not lying, [Bankman-Fried] was evasive, hair-splitting, trying to get the prosecutors to rephrase questions for him. I’ve been doing this job for close to 30 years. I’ve never seen a performance like that.”

“I reject the defense’s argument about loss, both on the law and on the facts,” Kaplan added. “The assertion that customers and creditors will be paid in full is misleading — defendants equate loss with dollar volume in the bankruptcy case.”

Bankman-Fried’s sentencing came after former FTX and Alameda executives Gary Wang, Caroline Ellison, Nishad Singh and Ryan Salame pleaded guilty and entered plea deals with the prosecution.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Additional reporting by Geraint Price, Sam Bourgi and Felix Ng.