Data shows the cryptocurrency derivative market has observed mass liquidations following the crash of Bitcoin and other assets.

Bitcoin Has Seen Bears Winning As Price Has Plunged 6% Over The Past Day

Recently, Bitcoin has been stuck in consolidation in the $60,000 to $70,000 price range, unable to mount any sustained move in either direction. During the past day, however, the coin has seen a significant move away from this range, and it’s not in the direction the bulls would have wanted.

The below chart shows what the price action of the cryptocurrency has looked like recently.

The price of the coin has observed a plunge over the past couple of days | Source: BTCUSD on TradingView

During this latest plunge, BTC briefly slipped to a low under $57,000 before seeing a small rebound to the current $57,500 mark. This is the lowest that the asset has been since late February.

As is usually the case, the rest of the sector has also burned alongside the original cryptocurrency, but Bitcoin’s 6% drop in the last 24 hours is deeper than that of many altcoins.

With the emergence of this new sharp price action in the market, it’s not surprising that the derivative market traders have been caught off-guard by the breakout of the range.

Crypto Derivative Market Has Seen Liquidations Of Over $424 Million

According to data from CoinGlass, the market volatility has triggered a high amount of liquidations in the derivative side of the sector. The “liquidation” of a contract occurs when it amasses losses of a certain degree and receives forceful closure from the platform with which it’s open.

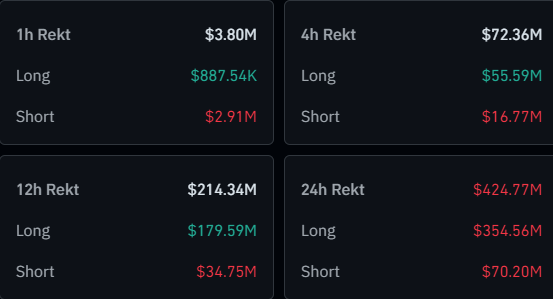

Here is the data regarding the cryptocurrency-related liquidations that have occurred during the past day:

Looks like a huge amount of liquidations have occurred over the last 24 hours | Source: CoinGlass

The table shows that the cryptocurrency market as a whole has suffered almost $425 million in liquidations during this period. Given that the price action across the sector has been towards the downside, it’s unsurprising to see longs making up for most of this flush.

More specifically, $354 million of these liquidations came from the long contract holders, making up for more than 83% of the total. A mass liquidation event like today’s is popularly known as a “squeeze,” since this latest one involved an overwhelming majority of the longs, it would be called a long squeeze.

During a squeeze, a sharp swing in the price causes a large number of liquidations, which feed back into the move, amplifying it and resulting in even more liquidations.

Given its position as the coin with the most market cap, Bitcoin has naturally occupied the largest part of the individual contributions to this squeeze.

BTC appears to have seen $164 million in liquidations during the past day | Source: CoinGlass

Historically, large-scale liquidations like this latest one haven’t been rare in the cryptocurrency market. This is because the various coins can be quite volatile, so it can be hard to bet on any one direction.

Related Reading: First In History: Bitcoin Miners Now Need More Than 1 EH/s Of Power To Mine 1 BTC

Leverage use is also widespread in the sector, with many platforms offering easily accessible extreme multipliers. With all the risky speculation, it’s unsurprising that the market shakes when price action like today’s occurs.

Featured image from Shutterstock.com, CoinGlass.com, chart from TradingView.com