Image source: Getty Images

The Stocks and Shares ISA is a great product for helping UK investors to prepare for retirement. With a generous £20,000 annual contribution allowance, they can supercharge an individual’s ability to build long-term wealth by saving a fortune in tax.

But investors don’t need to max out their allowance to make enough to retire comfortably. By investing shrewdly, an individual has a chance to build a huge pension pot with as little as £6,000 a year by drip feeding cash.

Here’s how even a 40-year-old starting from zero could build a large pension pot with a £500 regular monthly investment.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Reducing risk

Investing in a Stocks and Shares ISA is undoubtedly riskier than simply parking one’s money in a Cash ISA. Stock markets can be volatile and returns can fluctuate wildly from year to year.

However, share investors have a variety of shares, funds, and trusts they can choose from to manage the amount of risk they take on. One way to do this is to build a broad portfolio consisting of FTSE 100, FTSE 250, and S&P 500 shares.

One tactic could be owning between 10 and 15 different shares spanning various sectors. More risk-averse individuals could spread the risk further by buying one or more exchange-traded funds (ETFs) that invest in a basket of shares.

Moreover, building a portfolio of large- and mid-cap UK and US shares helps investors reduce risk through geographical diversification.

… while still building big returns

The good news is that diversifying to manage risk needn’t harm an investor’s ability to build wealth. And especially over the long term as the impact of temporary market volatility is gradually smoothed out.

In recent decades, the FTSE 100 has delivered an average annual return of 7%. The FTSE 250’s provided a return of 11% over the same timeframe. Leading the pack, the S&P 500’s delivered a 13% average return per year.

While past performance is not a guarantee of future returns, I think an average annual return of 9% is quite possible going forwards, based on these figures. And for a 40-year-old starting out, this could create transformational wealth by retirement.

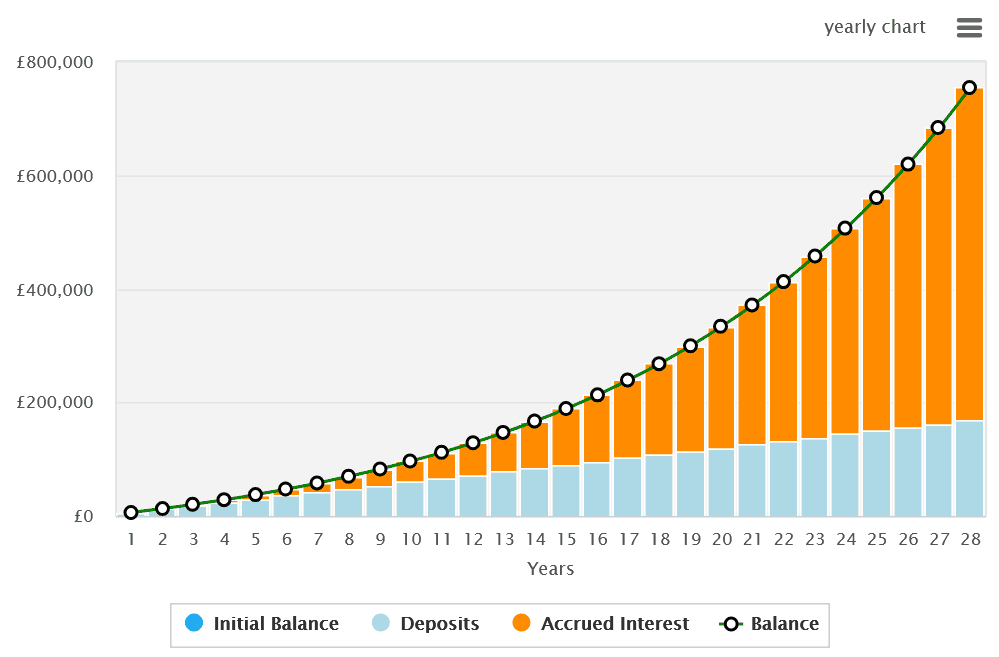

With dividends reinvested, a £500 monthly investment in a Stocks and Shares ISA would create a pension pot of £754,151 by the time they reach the State Pension age of 68.

Starting out

There are many top UK and US shares investors can buy to achieve these returns. Those starting their journey may want to consider an investment trust like the Polar Capital Technology Trust (LSE:PCT) instead.

Products like this provide instant diversification while keeping trading costs at a minimum. In this case, investors spread their capital across 102 companies spanning the US, Europe, and Asia.

On the downside, a narrow focus on technology stocks like Nvidia, Microsoft, and Taiwan Semiconductor Manufacturing Company can lead to disappointing returns during economic downturns.

However, the long-term returns could also be considerable. This is because it provides exposure to myriad fast-growing technologies like artificial intelligence (AI), robotics, and the Internet of Things (IoT).

This is illustrated by the trust’s exceptional average annual return of 19.4% since 2014. If this performance continues, investment here could help an individual build that huge Stocks and Shares ISA even sooner.