Image source: Unilever plc

I really like the investment case for Unilever (LSE: ULVR). So too, it seems, do other investors. The Unilever share price has surged 23% this year.

For a long-established blue-chip firm in a mature industry selling everyday staples, that seems like a big jump.

Why I like the investment case

To start, let me explain why I like the Unilever investment case in general.

It operates in an area that is likely to see high and sustained demand for decades (dare I say, perhaps even centuries) to come. Shampoo and laundry detergent may not be exciting business areas, but I do not see them going away any time soon.

Such markets tend to attract a horde of companies keen for a slice of the pie. By spending decades investing in building up premium brands such as Dove and Marmite, Unilever has helped set itself apart from the crowd.

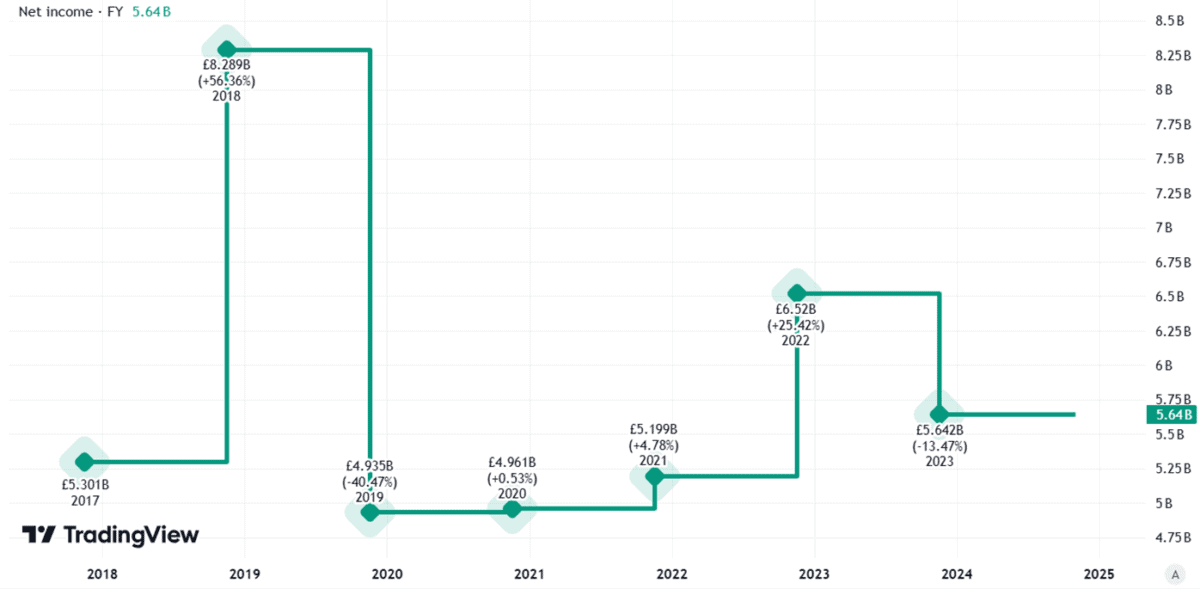

That gives it pricing power, which in turns helps generate profits. Yes, the company’s profits have moved about in recent years. But they have consistently been in the billions of pounds.

Created using TradingView

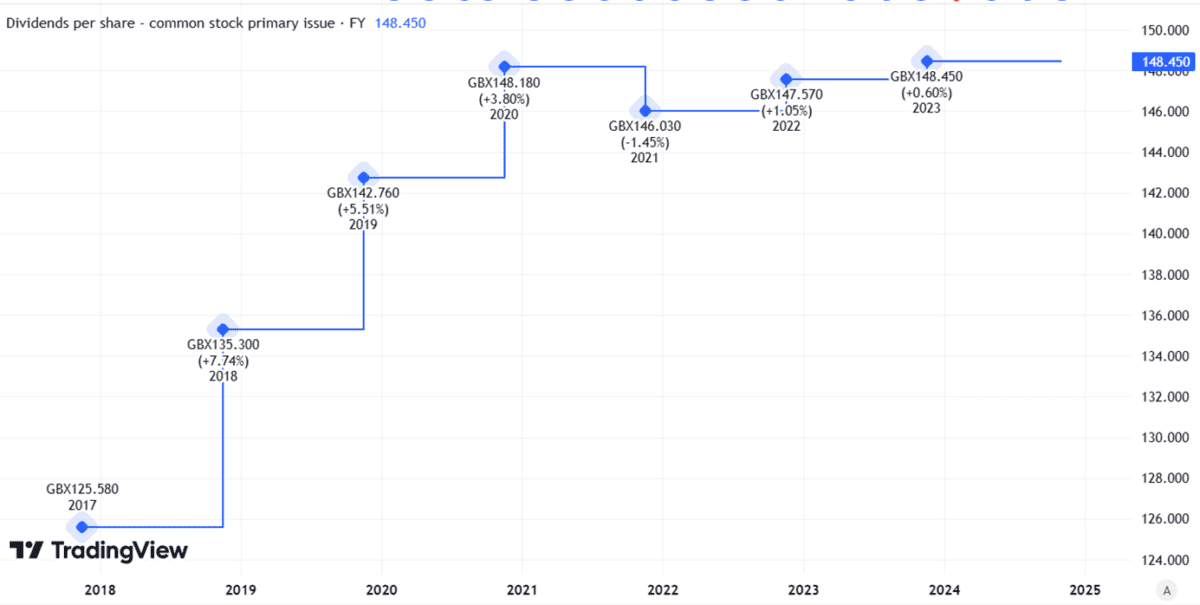

In turn, that helps fund dividends.

Created using TradingView

Revisiting Warren Buffett’s takeover attempt

Is it a coincidence, then, that Warren Buffett tried to buy Unilever – not some shares in it, but the whole caboodle – in 2017?

I would say not at all.

Unilever has all the hallmarks of a classic Buffett investment: a large, enduring market, strong competitive advantage and proven cash generation potential.

Understanding recent price moves

Buffett failed. That was at £40 per share. But, in the years since, the Unilever share price has repeatedly traded below (in fact, well below) that price.

So, why has it surged this year?

New management could be part of the explanation. Plans to cut headcount at the massive multinational dangle the prospect of lower costs, potentially boosting profit margins.

So too could a plan to spin off the ice cream business and focus on areas like personal beauty, with its attractive margins and no need for a tricky refrigerated supply chain from Cornetto factory to corner shop.

An investor event last week confirmed that it is on track to deliver on its cost-cutting goals and the firm also elaborated on its “Growth Action Plan 2030”. The company said it is on track to separate its ice cream business from the rest of the firm by the end of next year.

Not liking the share price

Still, that sounds like fairly slow progress to me. It suggests that buyers at the right price may not have been chomping at the bit (or at the Ben & Jerry’s).

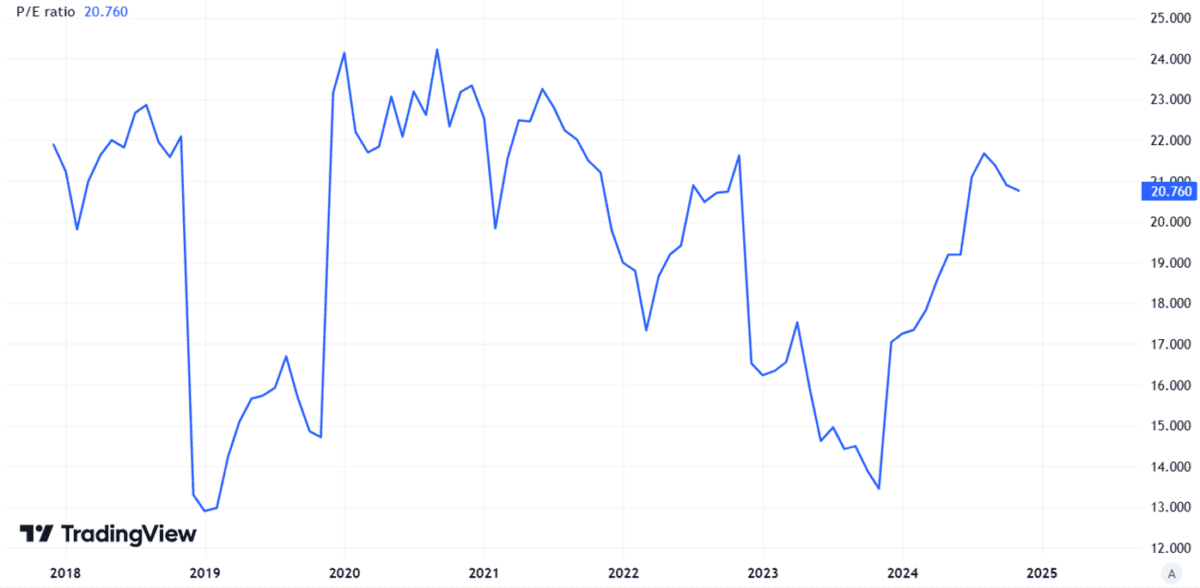

Meanwhile, growth plans are all well and good (though can be hard to deliver in such a mature business) but based on current performance, the Unilever share price-to-earnings ratio is already 21.

Created using TradingView

I do not think that is outrageous, but it is higher than I am comfortable with as a prospective investor, even though I like the Unilever investment case.

The company faces risks, from selling the ice cream business at too low a price just to get rid of it, to a weak economy pushing down demand for branded products. So for now, I have no plans to add Unilever to my portfolio.